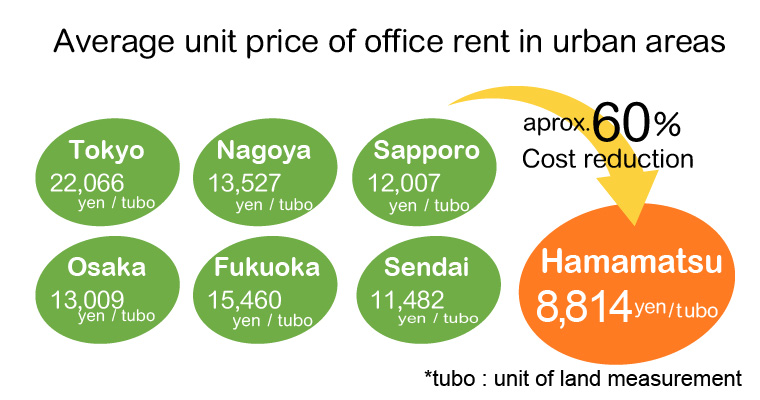

1.Cost reduction

Office Rent

The average rent of offices near Hamamatsu station is 8,814 yen per tsubo (= 3.3 square meters). Compared to the average rent per tsubo in Tokyo, about 60% cost reduction can be achieved.

(Source:Rent of offices near Hamamatsu station, Rental Information Site “Officely”)

Save labor cost for housing allowance, rent subsidy and commutation allowance

Average monthly rent in Hamamatsu is 55,000 yen for 1 bedroom apartment and 70,000 yen for 2 bedroom + 1 living room apartment. (Source:SUUMO Tokai)

Payment base of housing allowance and rent subsidy should depend on the company. However, because of the nature of financial assistance, the amount of allowance can be reduced.

In addition, as employees can commute to the office by using their private cars or short-distance public transportation, the amount of commutation allowance can be significantly reduced.

2.Tax incentive

You can receive various tax incentives by relocating office to a provincial city.

Tax incentives for strengthening local business facilities such as Tax cut for offices and Employment promotion taxation

- In the case of relocating all or part of the headquarters function from the 23 wards of Tokyo to a provincial city

- In the case of expanding regional office/relocating the office from the regions other than 23 wards of Tokyo to a provincial city

- Tax cut for offices and Employment promotion taxation will be applied.

Tax cut for offices

In the case of establishment or expansion of headquarters functions within regional revitalization areas, you can receive the special depreciation or tax deduction on the acquisition value of the business facilities.

- For relocation: 25% special depreciation or 7% tax deduction

- For expansion: 15% special depreciation or 4% tax deduction

[Example] In the case of building a new office with the acquisition value of 90 million yen (for relocation)

Special depreciation: 22.5 million yen or tax deduction: 6.3 million yen

Employment promotion taxation

It is applicable to the employees newly hired in the region or transferred to the region.

The maximum 900,000 yen tax deduction per person (for relocation)

*Tax deduction rates are different between relocation and expansion.

*The limit and condition of application are specified for Tax cut for offices and Employment promotion taxation. Please contact Office for the Promotion of Regional Revitalization, Cabinet Office for details.

Tax incentives for strengthening local business facilities unique to Shizuoka Prefecture

Shizuoka Prefecture offers support measures including one of the best tax incentives in Japan for the companies to relocate or expand their headquarters function, and the number of approved cases is ranked first in Japan. (As of December 31, 2021)

Tax incentives for strengthening local business facilities(Shizuoka Prefecture Website)

Business tax (prefectural tax) exemption

Real estate acquisition tax (prefectural tax) exemption

* 95% exemption for expansion

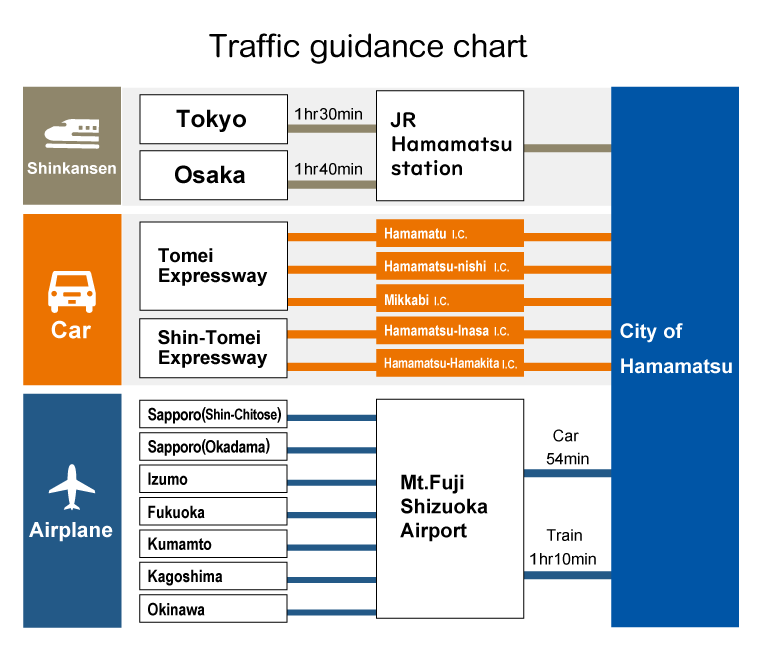

3.Outstanding traffic convenience

- Hamamatsu is located along the Tokaido, halfway between Tokyo and Osaka. The Tokaido Shinkansen (Hikari express) stops at Hamamatsu station.

- Using Shinkansen, you can go to Tokyo in 1 hour and 30 minutes and to Osaka in 1 hour and 40 minutes.

- There are several interchanges of important traffic routes: Tomei Expressway and Shin Tomei Expressway in the city.

- Mt. Fuji Shizuoka Airport is located about 50 minute drive away from Hamamatsu and operates seven domestic flights. (Flight routes to Sapporo (New Chitose), Sapporo (Okadama), Izumo, Fukuoka, Kumamoto, Kagoshima, Okinawa)

4.Creation of new business opportunities

- Hamamatsu is a government ordinance city with a population of about 800,000 and the number of businesses of about 37,000. The scale of business market is also more than enough.

- Industrial clusters have been developed by accumulated small and medium-sized enterprises and venture companies that own advanced technical capabilities to support large enterprises successfully operating globally, such as Suzuki, Yamaha, Honda, Kawai, Hamamatsu Photonics, Roland and FCC.

- Local financial institutions also work on to provide opportunities for local related agencies and corporate managers to interact each other.